Contents

Interest

Most of us are familiar with the concept of interest in our daily lives. If we invest $100 at 10% interest for a year, at the end of the year we will have $110. If we waited another year we would have $121. If you thought that we should have $120, look again. 10% of $110 is $11, so if we add this amount to what we have, we get $121. This phenomenon is called compounding interest, where we get more and more money from an investment as time goes on, even at the same interest rate because interest is accruing based on all the money we have now, not just what we started with.

Supply and Demand

Consider a good that is being sold in many places across a nation. From the perspective of a consumer, generally a higher price will mean fewer units of the good are sold. Generally a lower price will mean that more units of the good are sold. From the perspective of a producer however, the higher the price is, the more they will want to produce of the good. Again, the opposite is generally true as well; the lower the price, the less they will want to produce the good.

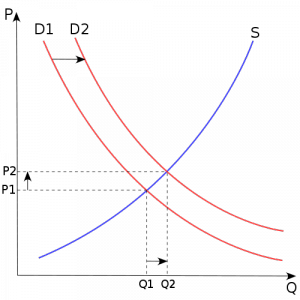

This can be represented by a graph, called a supply and demand curve. Here is an example of a supply and demand curve from the Wikimedia commons.

Price is indicated on the vertical axis, denoted as “P”. Quantity is on the horizontal axis, denoted as “Q”. The S curve is an example of a supply curve, and the D1 and D2 curves are examples of two slightly different demand curves.

When looking at the supply curve, we can see that an increase in price will create additional supply (the quantity goes up), while an increase in price stimulates a decrease in the amount demanded (the D curve). The point where the supply and demand curves cross corresponds to a point known as equilibrium.

This is the point where producers and consumers exchange goods at a cost and quantity that represents a balance between the consumer’s wish to pay less money and the producer’s wish to make more money. Equilibrium is the point where everybody willing to pay the market price has their demand satified, and anybody willing to produce at the market price has a buyer for the good. At any other point along either curve the market forces would drive supply and demand toward equilibrium. For instance, at a lower price, demand would outstrip supply. Unsatisfied consumers could offer to pay more to receive goods, and the increased price is an incentive for a profit seeking producer to produce more goods, causing supply to increase. In general, market forces will cause the market to move towards the equilibrium point.

Specialization

A labourer who hones skills with regards to one specific task will be more effective at the given task than someone who is unskilled. The market encourages people to develop special skill sets and trade their labour, or the products of their labour, with others for the things they need or want. Alternatively people could directly satisfy their own needs. The key to specialization is that a specialist can perform their work generally better and more quickly than a non-specialist.

Example: A group of five specialists could all trade their respective goods and services to each other. This five specialists would be more wealthy (capable of enjoying more free time, and having better quality goods and services) than five equally capable people who all worked to provide for all their own needs on their own without specializing and trading with each other.

This is one of the key benefits of market and trade concepts, as this interdependent network of specialists are capable of dramatically more effective action than would otherwise be possible.

Markets

A place where goods and services are exchanged. One might imagine a bustling street full of vendors and customers or a stock exchange full of people buying and selling stocks. These are physical manifestations of what we call a market, but the definition is not limited to these examples.

Goods and services are exchanged at many levels. We can imagine markets at a local, national, and global scale. We can still use those first mental images, but we should be aware that markets can span continents and cross borders. They manifest themselves in many ways. The most general rules that define the way a market acts is via supply and demand (see above). Markets are also places where discussions can happen between people and organizations regarding appropriate quantities and prices for their exchange of goods.

Capital

A useful definition of capital is anything that can enhance the ability to do economically useful work1 . Economically useful essentially means anything that has value to human beings. There are many ways to produce value, so it makes sense that there are several types of capital that we can refer to.

Human Capital

Human beings who can perform useful work. This includes physical as well as mental work and specialized skills. Investment in improving human capital is generally through education and training. Accumulation of human capital could also mean hiring people who are useful for doing work.

Financial Capital

Financial capital is essentially just money. It isn’t just money that is ‘in hand’ however. It refers to the ability to use money to acquire other forms of capital. In this way the ability to take on debt by borrowing from someone else is a form of financial capital. High value commodities such as gold are often considered as being another form of financial capital.

Physical Capital

Factories, roads, buildings, and tools are all good examples of physical capital. These are non-human, non-monetary objects that are useful for conducting valuable work.

Social Capital

A company that is well-regarded by the populace would have more ‘social capital’ than a company that is poorly regarded, all else being equal. Social capital refers to the power of social networks to accomplish work. This could be due to enhanced communication abilities, or it could be simply customer loyalty. There are many forms that social capital could take.

Natural Capital

Land, forests, rivers, rainfall, wind, sunlight, animals, and everything else that comprises the natural world is regarded as natural capital. One could think of this as the category that includes everything else other than the above forms of capital.

Externality

In economics an externality is something that affects other people who are not part of a specific economic exchange/interaction, but is not accounted for in the price of the transaction in question. Externalities can be positive or negative. Positive externalities are good for people not involved in the trade in question, while negative externalities are bad. An example of a positive externality would be a nice office building in a city makes the city seem more prosperous and civilized, causing people to enjoy living there more. An example of a negative externality would be pollutants emitted by coal power plants. These pollutants can make people and animals ill, damage forests and crops, and damage buildings with acid rain.

Corporations are referred to as ‘externalizing machines‘ by critics of the corporate model. This refers to negative externalities that they do not want to pay for. The company that owns a coal power plant will do their best to not have to pay for the full costs of their effects on the environment, health, and infrastructure. Corporations are mandated with producing profits for their shareholders. In order to serve this mandate effectively they will make sure that negative externalities stay just that – external. If a company internalizes an externality, it means that they will be shouldering some of the additional cost being incurred to others. Some companies choose to do this for ethical reasons, or to gain additional social capital. Generally it is the role of government to enforce policy that makes companies take responsibility for the full cost of their actions. An example of this sort of policy would be government forcing coal power plants to include scrubbers that remove some of the dangerous pollutants from the gases emitted from their plants.

Purchasing Power Parity

Purchasing Power Parity (PPP) is a term indicating equal buying power. The same standard of living costs different amounts of money in different places in the world. Economists define what is called a ‘basket of goods’ that are available everywhere that markets exist2 . We can imagine a hypothetical basket that would cost $120 USD in the United States, and 100€ in France. These numbers are intended to be illustrative, not real. We can see then that $6 USD has the approximate buying power of 5€ in this example. It would thus cost more USD than euros to obtain the same value of goods. Therefore we can adjust our perceptions of income levels accordingly for these countries, since in our example one USD does not buy as much in the United States as one euro buys in France.

It can be difficult to compare the products in wealthy nations with those in the poorest, as product quality can vary greatly and this is difficult to quantify numerically. This can cause the PPP of poor countries to be overstated. PPP is closely related to currency exchange rates, but it is not the same thing. For more information on the subject, see the Wikipedia article on Purchasing Power Parity. The differences in prices that cause the basket of goods to be more or less expensive can be caused by a myriad of factors that we will not go into here.

Gross Domestic Product

Gross domestic product (GDP) is an economic measure intended to represent the sum of all economic activity in a country. Economic activity is measured according to market value3 . Therefore GDP is the sum of all market value delivered in a country. This quantity is usually presented on a yearly scale. GDP is often given in terms of PPP, since it is a more accurate reflection of buying power4 . ‘Nominal’ GDP is when GDP is calculated without taking into account PPP5 . If you view the previous two citations, notice that the GDP of The People’s Republic of China is given for 2009 as 4,908,982 million USD (nominal) and 8,765,240 million USD (PPP) by the International Monetary Fund. This striking difference is apparently largely due to the fact that China ‘pegs’ its currency at a specific value compared to the USD. Part of their motivation to do this is to ensure that their largest export market, the United States, can buy goods from them at a consistent price. The effect on nominal vs PPP GDP for China is drastic, with the nominal value being only about 56% of the PPP value.

- Wikipedia: Capital, Retrieved Sept 19, 2010 [↩]

- Wikipedia: Market Basket [↩]

- Wikipedia: Gross Domestic Product [↩]

- Wikipedia: List of Countries by GDP PPP [↩]

- Wikipedia: List of Countries by GDP (Nominal). [↩]

11 thoughts to “Economics: Key Terms and Definitions”